If you’ve been wondering whether now is the right time to buy a home, you're not alone. Between rising home prices and fluctuating interest rates, it can feel overwhelming to make a decision. But according to real estate experts, waiting might actually cost you more in the long run.

Home Prices Are Still Climbing

One thing is clear: home prices continue to rise. Recent reports show that home values are up compared to last year—and experts predict this trend will stick around. Demand for homes remains strong, and there simply aren’t enough houses on the market to keep up. That means prices are likely to keep climbing, not fall.

In other words, the longer you wait, the more you could end up paying for the same home.

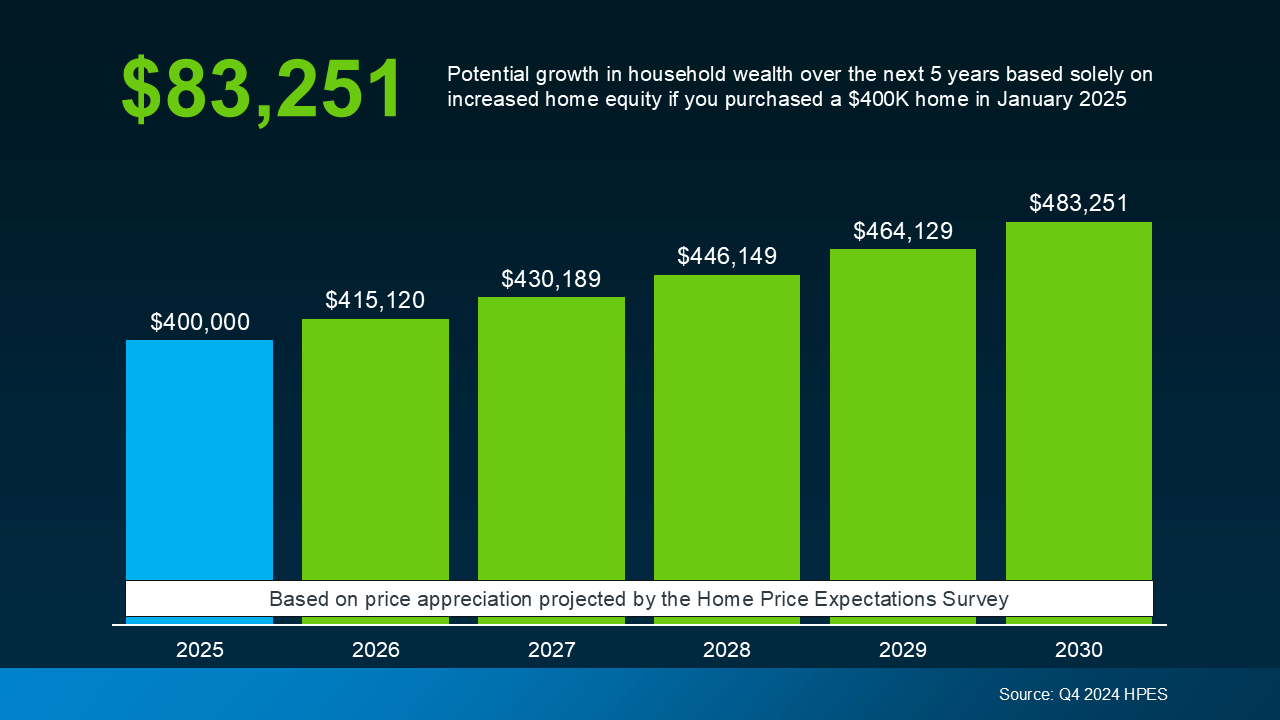

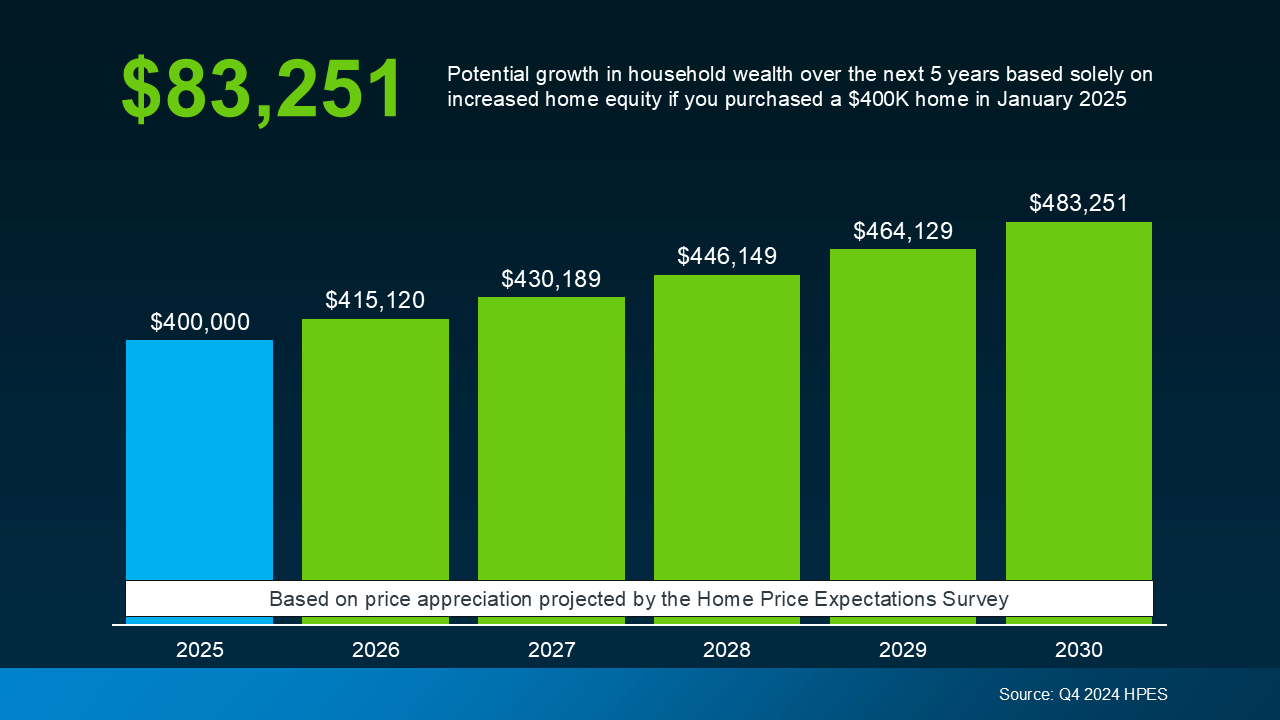

Fannie Mae recently released the Home Price Expectations Survey where industry experts are projecting home prices to continue at a more modest rate compared to recent years. Nationally they are expecting home prices to rise around 4% annually.

Reasons to purchase a home now

With home prices projected to steadily increase over the next few years, there are a few things to take into consideration:

- The longer you wait to purchase your dream home, the more the purchase price will go up

- Waiting for mortgage rates to drop could backfire. If rates dip slightly, the savings could be offset by rising home prices and make it more expensive overall.

- Buying a home now means you start to build equity sooner. With home prices expected to rise, your investment will start building equity as soon as you purchase it.

If you were to wait 5 years to purchase a home, you could miss out on a significant amount of equity. Based on the Fannie Mae survey, if you were to purchase a home for $400,000, you could miss out on $83,251 in increased home equity.

Buying Now Could Be a Smart Move

Taking all of this into account, buying sooner rather than later could be a wise decision. Not only could you avoid paying higher prices down the road, but you could also start building wealth through homeownership right away.

Of course, everyone's financial situation is different. It’s important to talk to a trusted mortgage lender to figure out what makes sense for you. But if you’re ready and able, getting into the market now could be a smart move toward your long-term financial goals.

Ready to start house hunting? Curious to see what today’s rates are? Connect with one of our experienced loan officers by giving us a call at (844) 326-5054 or by clicking "Apply Now" below.

The content on this site is intended for informational purposes only and should not be considered accounting, legal, tax, or financial advice. First Federal Bank recommends that customers conduct their own research and consult with professional legal and financial advisors before making any financial decisions. Links to third-party websites may be provided for your convenience; however, First Federal Bank does not guarantee the reliability, accuracy, or safety of the information, products, or services offered on these external sites. We are not liable for any damages resulting from the use of these links, and we do not investigate, verify, or endorse the content or opinions expressed on any third-party sites.

-1-1.png)